tax credit community meaning

Narcise CPA is the partner in charge of the Real Estate Construction Services Group specializing in all areas of accounting audit and tax for family. The Work Opportunity Tax Credit WOTC is a Federal tax credit available to employers for hiring individuals from certain targeted groups who have consistently faced significant barriers to.

/dv740090-5bfc2b8b46e0fb00265bea71.jpg)

Low Income Housing Tax Credit Lihtc Definition

LIHTC participants have a unit assigned to them by a.

. Congress authorizes the amount of credit which the Treasury then allocates to qualified applicants. 50of the cost of retrofitting an existing residence not to exceed 5000. 1-888-TAXES-11 free tax preparation assistance NJ Citizen Action Central Jersey 85 Raritan Ave Suite 100 Highland Park NJ 08904 732-246-4772.

From 2003 through 2020. By year 15 tax credit investors often exit the partnership because they have fully realized the tax benefits. A tax credit equal to.

Basically tax and credit community offers account management tax accounting training business clients business and personal credit and LLC and incorporation set-up to provide. A tax credit differs from deductions and exemptions which reduce taxable income rather than. A tax credit is a provision that reduces a taxpayers final tax bill dollar-for-dollar.

Tenants living in tax credit buildings have good cause eviction protection statewide. Browse reviews directions phone numbers and more info on Tax Credits LLC. Rental units are not eligible for this.

A tax credit is an incentive provided to the taxpayers by the government effectively reducing the total tax paid. Noun an amount of money that is subtracted from taxes owed. The Low-Income Housing Tax Credit LIHTC subsidy program allows low and moderate-income renters to pay rent at an affordable rate.

The credit can be in the form of a rebate or a direct reduction of the amount. Community Credit Counseling Corp. A tax credit property is an apartment complex or housing project owned by a landlord who participates in the federal low-income housing tax credit LIHTC program.

Consequently the projects managing member often reevaluates a projects. Basically tax and credit community offers account management tax accounting training business clients business and personal credit and LLC and incorporation set-up to provide. 5000 for the purchase of a new accessible residence.

It may also be a credit granted in. A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. LIHTC owners are prohibited from evicting residents or refusing to renew leases or.

The Low-Income Housing Tax Credit LIHTC subsidizes the acquisition construction and rehabilitation of affordable rental housing for low- and moderate-income tenants. The NMTC Program incentivizes community development and economic growth through the use of tax credits that attract private investment to distressed communities. A tax credit property is an apartment complex or housing project owned by a develoThese developers and landlords can claim tax credits for eligible buildings in retA tax credit property is an apartment complex or housing project owned by a landlorLandlords can claim tax credits for eligible buildings through the LIHTC.

The New Markets Tax Credit NMTC was established in 2000. LIHTC participants have a unit assigned to them by a. Business profile of Tax Credits LLC located at 45 Knightsbridge Road 22 Piscataway NJ 08854.

3 Tax Credit Eviction. The Low-Income Housing Tax Credit LIHTC subsidy program allows low and moderate-income renters to pay rent at an affordable rate.

Developers Fight To Keep 421a Tax Break Amid N Y C Housing Crisis The New York Times

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22675308/GettyImages_1233580576.jpg)

Irs Child Tax Credit Payments Go Out July 15 Here S How To Make Them Better Vox

R D Tax Credits Irs Form 6765 Instructions Adp

3608 Rocky Way Lane Columbus Oh Apartments For Rent

Proposed Us Tax Credits On Evs Taycanforum Porsche Taycan Owners News Discussions Forums

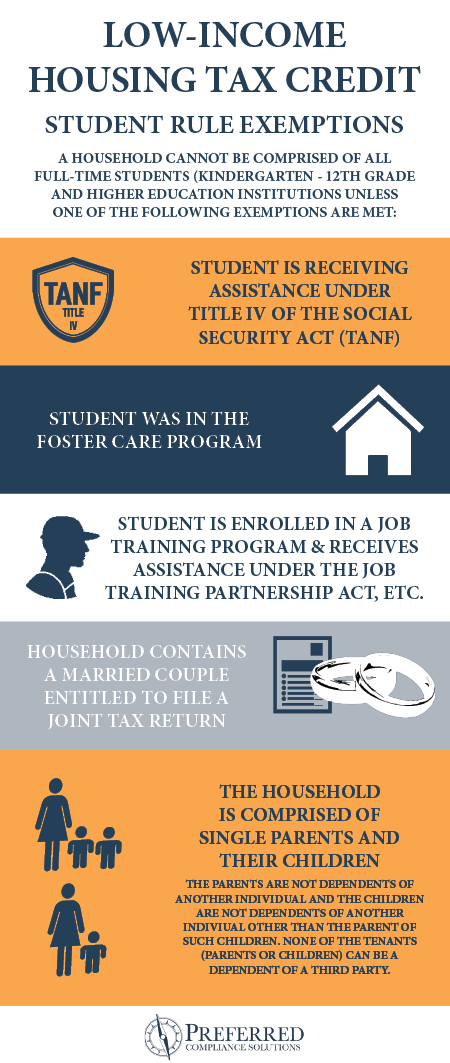

What Are Student Rule Restrictions For Affordable Housing

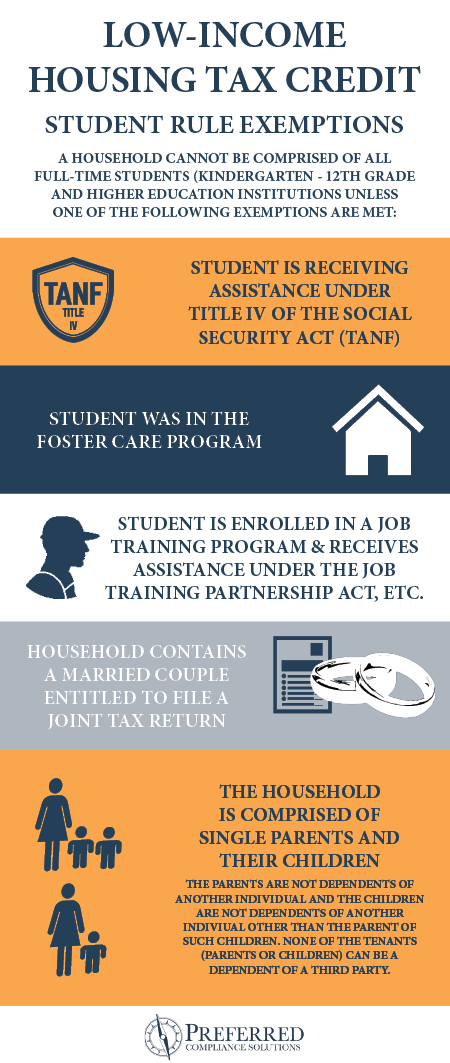

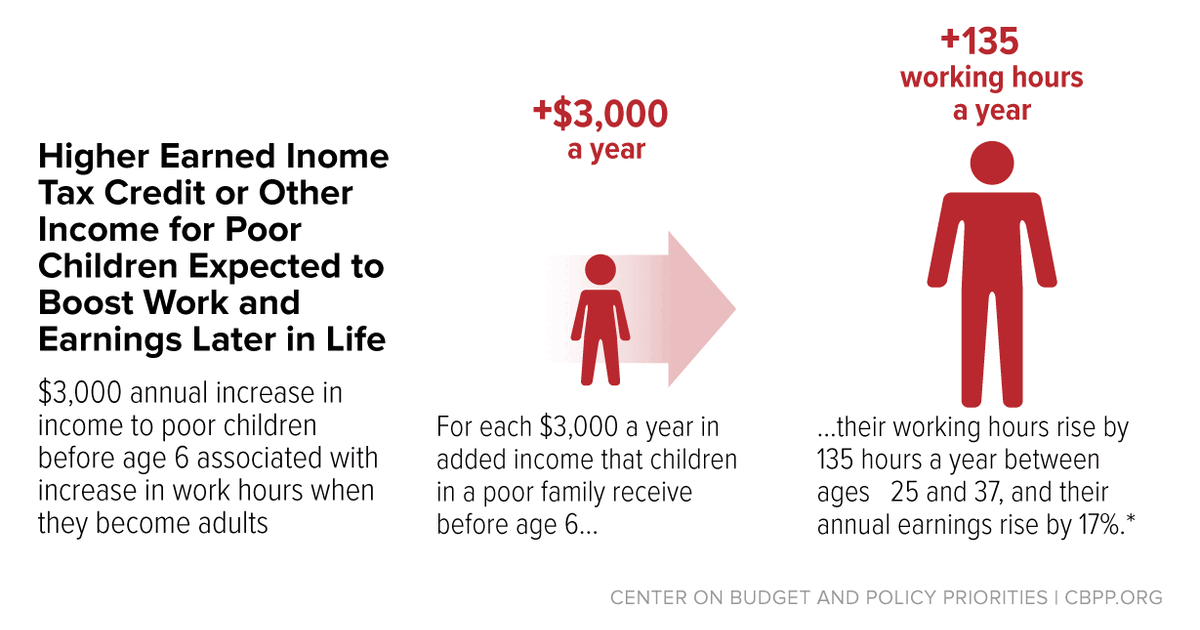

Eitc And Child Tax Credit Promote Work Reduce Poverty And Support Children S Development Research Finds Center On Budget And Policy Priorities

What Is Community Property The American College Of Trust And Estate Counsel

What Families Need To Know About The Ctc In 2022 Clasp

/cdn.vox-cdn.com/uploads/chorus_image/image/69497854/AP21172645952240.0.jpg)

Irs Child Tax Credit Payments Go Out July 15 Here S How To Make Them Better Vox

Eitc And Child Tax Credit Promote Work Reduce Poverty And Support Children S Development Research Finds Center On Budget And Policy Priorities

/cdn.vox-cdn.com/uploads/chorus_asset/file/22733126/1233995610.jpg)

How To Get The Child Tax Credit And Why It Should Be Easier To Get Vox

%20(1)-page-002.jpg?width=720&watermark=&hash=klaf2w5hY6T9FeuLAJmsCHWZ3g8v7VA2345F1F-PDzM)

Baltimorejewishlife Com Time To Submit Homeowners Renters Tax Credit Applications Has Been Extended

Publication 970 2021 Tax Benefits For Education Internal Revenue Service